What's Wrong With Net Income

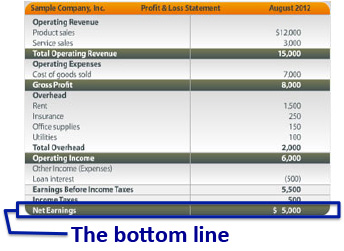

Net Income or net earnings is a formal accounting figure that represents the profit of a company in a given period, after all income has been recognized, including gains on the sales of assets, and after all expenses have been deducted, including extraordinary and non-operating expenses.

Because it includes all of those non-recurring figures, net income can distort the degree to which value has been created in any given period.

Consider the following examples...

Example 1: Sale of land

Let's say that a company with an $800,000 drop in operating income sells land that has been on its books for decades for a $1 million gain. The company overall would show a net income gain of $200,000, with a decline in operating profits more than offset by the one-time gain on sale. If managers are most accountable for net income, then this performance looks good.

Let's go one step further, and suppose that comparable land was selling for 20 percent more than what the company got because they were rushing to sell it before the end of the fiscal year. Then, what looks like a $200,000 overall profit actually disguises not only an $800,000 operating loss, but also an opportunity loss of $200,000 on the land transaction.

Example 2: Extraordinary loss

Let's say that a company increased its operating profit by $800,000, but also decided to reorganize a division in order to further boost its future profitability by an additional $200,000 per year, starting next year, with the re-organization costing $1 million in severance, disposition, and related costs. Now, instead of recording an increase to reflect its improved performance, the company records a $200,000 loss.

Next year, if the management is still around (and other things being equal), their firm will show a $1 million increase in net income. This increase will have been entirely due to the efforts of the prior year, when net income dropped. In this case, from one year to the next, net income would show the opposite of what is actually happening in value creation.

And we are still missing one cost

Net income ignores the cost of equity. To the extent that the company can use equity--via the issuance of stock, or cash from retained earnings--to grow its profits, net income may fail to reflect value creation.

When it works

Net income can be a reasonable proxy for value creation if your company:

- Does not have, or expect to have, non-recurring income or expenses,

- Re-invests each year an amount roughly equal to its depreciation.